Table of Contents

Once you have set up a tax rate, you will have to assign it to a tax class for it to work properly. This tax rate will be applied to any product that is assigned to that tax class.

How to Add a Tax Rate to a Tax Class

- Log into your OpenCart Dashboard

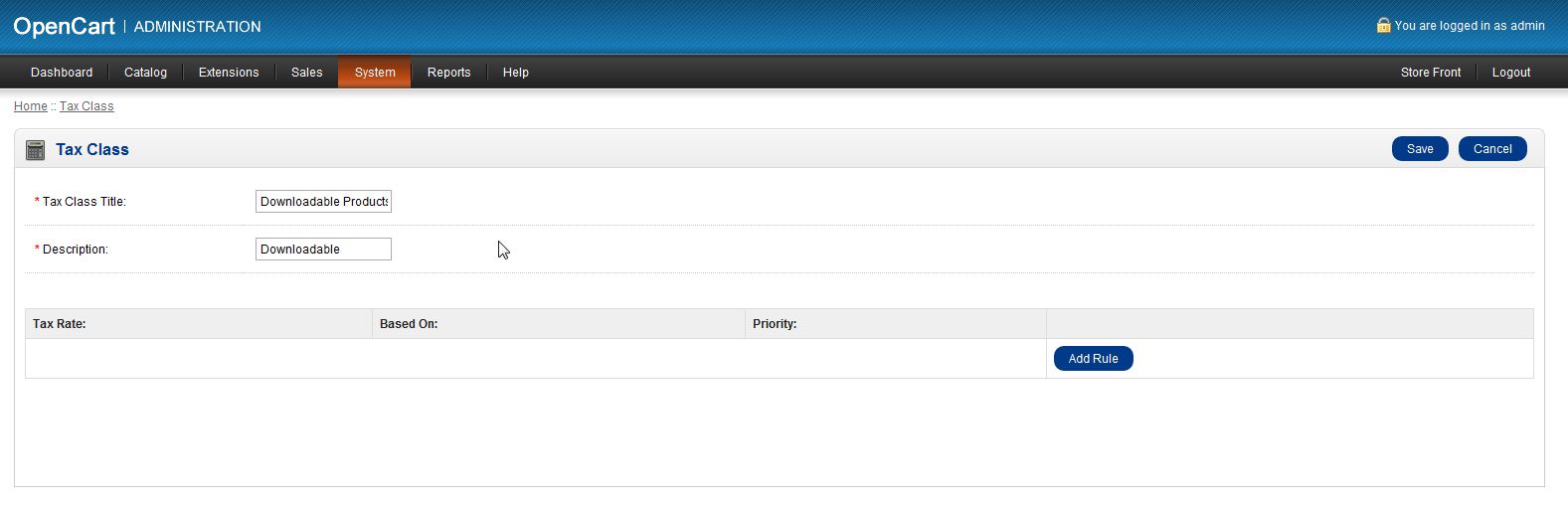

- Go to System > Localisation > Taxes > Tax Classes

- Click on “Edit” for the tax class you want to apply the tax rate to

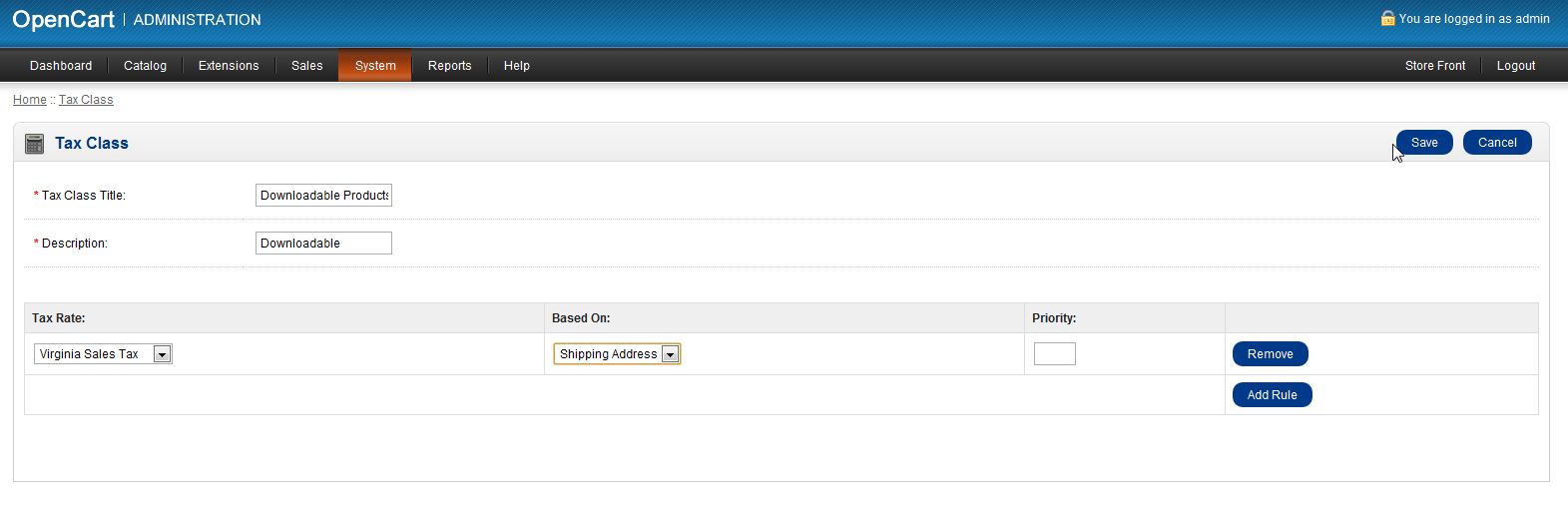

- Select “add rule” to add a tax rate and from the drop down menu choose the tax rate and what address you want the rule “Based On”

- Click “Save” in the upper right corner

Now, if one of your visitors purchases a product that is assigned to that specific tax class and the address they enter matches the Geo Zone assigned to the Tax Rate, the tax will be applied to the product.

If you need further assistance please feel free to ask a question in our support center website.